Where can insurers search for growth in an increasingly competitive Property and Casualty (P&C) insurance market?

Insurers are facing strong competition from inside and outside industry, including digital competitors, insurtechs, and vertical integration of ecosystems. What’s more, policy holders’ standards for personalized engagement have never been higher! They are a far cry from the transactional, one-size-fits-all experiences that were once the norm. Nowhere is that truer than for insurance.

At inQuba, we’ve seen journey-centricity achieve a 25% – 40% increase in onboarding conversion. As discussed in our previous blog, client journeys and business revenue are closely linked, which is why leading insurers are turning to Customer Journey Management, a break-through approach compared to traditional CX.

Use Case – upping the onboarding conversion rate

As an insurance professional, you know that the customer journey is as important as the products and services you sell. In fact, research confirms that 84% of customers value the experience a company provides as much as its products and services*. There’s no point fixating on the product if the experience is bad! Tailored, contextualized engagement across multiple channels is the benchmark.

Our client, a multi-million-dollar P&C and life insurer established in the late-90s, approached inQuba to radically improve conversion in the policy holders’ onboarding journey. Prospects showed intent, they had a discussion, and then they stalled. The eventual solution would result in optimization of the journey through an interaction framework, ultimately assisting clients to achieve their goals.

Generating inbound calls is only half the battle won — converting them is the real challenge! Inbound marketing enables customers to contact the company when it best suits them, which should yield higher conversion rates – and profitability – in the long run. But there are various factors that produce friction along the way (UX, representatives, confusing processes, etc.) and understanding these factors and implementing the right conversion strategies is what’s most important.

So, how did we ensure that inbound calls were converted into policy sales?

What does the onboarding journey really look like?

The first step was to expose the prospects’ actual journeys during the onboarding process. This step uses existing data to visualize actual behavior and drop-offs, and is always uncomfortably revealing compared to the conceptual journey maps in the business.

In this case, existing data was used to reveal and visualize some interesting paths. Leads from inbound marketing (ads, landing pages, etc.) were showing intent but many were not progressing after first contact. While some didn’t qualify due to affordability, others changed their minds or became uncontactable. Only about 40% were being quoted, and only about a third of those went on to sign. It was clear that the process could be optimized for greater success!

Why prospects were stalling after first contact

- Unreachable

- No longer interested

- Do not qualify

- Already existing client

Where is the value being delivered?

Having identified the drop-off points in the policy onboarding journey, feedback was gathered at each point to understand which parts were delivering value for individual customers and customer segments. This feedback was used to understand why people dropped off – for example, a complicated quote process, poor understanding of products, lack of ability to compare products, no personalized advice or brand and industry trust issues – as well as the types of interventions needed.

Together with exposed customer behavior, this insight was used to understand the journey customers take, and to design targeted dialogues and multi-channel nudges – moments of positive reinforcement that can influence a person’s motivations and decision-making.

These granular insights, referred to as Journey Analytics, also allowed for contactability analysis to understand the various segments of leads and how best to ensure and maintain dialogue with each. This would include everything from times of day to channel preferences.

And then it was time to orchestrate for conversion!

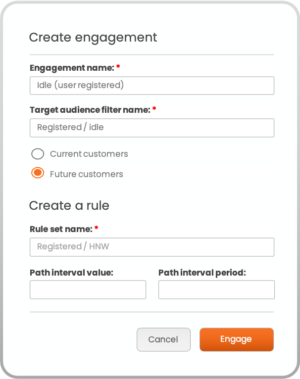

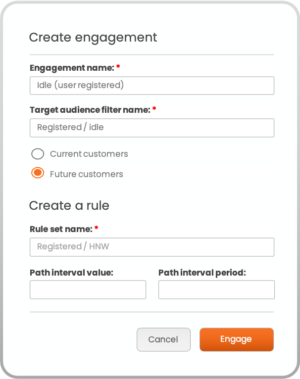

Orchestrating onboarding journeys for conversion

For our client, we introduced a simple new step in the process. Once the prospect had contacted the call center, indicating that they want to have a conversation, a personalized chat dialogue (WhatsApp in this case) was initiated with the prospect. This was the first element of the Journey Orchestration. This provided the prospect with various convenient options for progressing. With instant chat solutions, communication is immediate and personal, and messages are shared instantly. The service representative can agree on the best time to call back, and they can remain in contact when the prospect has to re-schedule, and even send reminders when necessary. It’s all about placing the customer at the heart of the journey.

Why is this important?

Timing is everything when it comes to conversion. Wait too long and even the most qualified leads can drop off. It’s called speed-to-lead for a reason.

Think about the importance of a fast and seamless customer communication experience, especially for the new generation of consumer who expects everything to be painless and intuitive. Customer confidence is built on urgency and personalization because it shows that you value their time and appreciate their prompt responses. When insurers don’t get the onboarding right, drop-off rates shoot up, and would-be policy holders are lost forever.

Orchestrating onboarding journeys for conversion

For our client, we introduced a simple new step in the process. Once the prospect had contacted the call center, indicating that they want to have a conversation, a personalized chat dialogue (WhatsApp in this case) was initiated with the prospect. This was the first element of the Journey Orchestration. This provided the prospect with various convenient options for progressing. With instant chat solutions, communication is immediate and personal, and messages are shared instantly. The service representative can agree on the best time to call back, and they can remain in contact when the prospect has to re-schedule, and even send reminders when necessary. It’s all about placing the customer at the heart of the journey.

Why is this important?

Timing is everything when it comes to conversion. Wait too long and even the most qualified leads can drop off. It’s called speed-to-lead for a reason.

Think about the importance of a fast and seamless customer communication experience, especially for the new generation of consumer who expects everything to be painless and intuitive. Customer confidence is built on urgency and personalization because it shows that you value their time and appreciate their prompt responses. When insurers don’t get the onboarding right, drop-off rates shoot up, and would-be policy holders are lost forever.

But we didn’t stop there.

Other than the WhatsApp dialogue that encouraged initial progress, the entire onboarding journey was seeded with digital nudges and interventions to ensure that prospects weren’t lost:

- Those prospects who stalled before accepting the quote were nudged digitally with a reminder

- Those who said they were no longer interested were channeled into objection handling to gather more information and offer them alternatives

- Those who didn’t qualify initially were nudged towards alternative products

- Those who were difficult to reach were engaged through WhatsApp to re-establish contact

- Those who were existing policy holders were upsold or cross-sold depending on their needs

Orchestration is the process of nurturing customer trust through built-in engagements that are personal and contextual, and designed to ultimately improve the experience, conversion and retention. At inQuba we’ve seen similar onboarding conversion by 25% – 40%.

Finally, feedback on the entire journey was gathered to compare the success of interventions with results drawn from control groups.

Optimizing for conversion can be a substantial unlock for today’s insurers that are encountering significant market pressures, new entrants and burgeoning consumer expectations. Customer Journey Management represents the key that unlocks customer delight and business revenue.

Use case coming up!

Look out for our third post in the series where we’ll be discussing how a leading insurer ensured safety and confidence for policy holders during the claims process. You’ll learn more about how real-time engagements between insurer, policy holder and suppliers improved confidence and loyalty.

We would love to understand your business challenges and the problems you’re trying to solve. Reach out to us and we’ll set you up with an expert for a no-obligation discussion.

Guide customer behavior with inQuba Journey Management

Download our product paper now

Read the full 4-part Insurance series now.

References: