As an insurance professional you spend a lot of time thinking about your policy holders’ journeys, especially in a business environment that has completely transformed. Young, agile insurtechs are entering the space with digital-first offerings for policy holders who have growing, digital-first expectations. It’s a good match if you’re there. While the last few years have accelerated digital transformation for insurers, many executives are still struggling to understand their policy holders’ real end-to-end journeys, or know how to correct them!

The link between policy holders’ journeys and business revenue has been firmly established, and multi-disciplinary teams at leading insurers are turning to Customer Journey Management, a break-through approach compared to traditional CX. Why? Because our clients’ real-time needs demand real-time insight and actionability. It sounds obvious but it’s not easy to achieve with legacy methods. At inQuba we’ve seen journey-centric approaches achieve some incredible results:

- A 31% increase in portal registration (insurance)

- A 34% increase in onboarding conversion (fintech)

- A 200% increase in customer engagement (insurance and investment)

- Significant boosts in customer satisfaction and NPS

Customer Journey Management is the laser technology of CX, offering precision targeting for important use cases such as policy holder acquisition, experience, retention and insight.

As an insurer, your two overarching challenges are policy holder acquisition and retention. While there’s some vague notion that both can be mastered through better service, the real solution is more nuanced. So, why is it often so difficult to achieve? Let’s look at some industry research from Investment Times, Accenture and others*.

Why is it difficult to get new policy holders to sign up?

1. A complicated quote process

The nature of quoting, especially for P&C, is such that it can become very detailed, very quickly. This is sometimes more than the prospect is emotionally ready for, and jumping through administrative hoops is tough on the knees! Prospects get overwhelmed, lose momentum, and then drop away.

2. It’s difficult to understand products

Insurance products can be complex, with lots of small print, conditions and exclusions. Policy holder education through traditional methods can be time-consuming and expensive.

3. Policy holders want to compare products

Comparison of individual insurance products can be a minefield for inexperienced policy holders, especially when exposure to them is so infrequent. The inability to compare reduces confidence and can overwhelm customers into inactivity.

4. No personalized advice

Each prospect comes with context and expects cover for their individual needs. And their needs are changing all the time. They don’t need what you offered to the last person.

5. Brand and industry trust issues

Trust is essential when covering your precious belongings, but difficult when there’s so little relevant engagement! Policy holders can spend most of their relationship with an insurer in an information vacuum.

Why is it difficult to keep policy holders?

1. Poor communication

Insurer communication is typically infrequent, sales-focused, and lacking the context of the policy holder. Active claims see a spike in interaction but it’s usually administrative. A one-size-fits-all approach to communication becomes unmeaningful and invisible quickly, and valuable information gets lost.

2. Poor service

Policy holders want to be kept updated when it matters most, and that’s usually when the boiler is already dripping (or any other household drama) and they don’t know where the team is! A lack of continuity and smooth handover of customer information between the insurer and their fleet of preferred service providers just adds to the problem.

3. Value of cover

Insurance is a low-touch business, but policy holders need to be continually reminded of the value and benefits of their chosen cover. Failing this, the relationship can be reduced to a monthly premium and a policy holder who’s trying to remember why they signed up! Value communications build loyalty and trust.

4. Denied claims

Claims are often denied for good reasons, but there’s policy holder shock due to a poor understanding of the policy. Again, this is a communication challenge for insurers who need to ensure understanding for the sake of retention when it matters most.

5. No cover as expected

Another communication challenge, especially when it emerges at claim time, is that policy holders don’t understand the intricacies of their cover or how the terms and conditions affect them.

Despite large sums of marketing dollars being spent to attract prospects, they continue to drop off the sales and onboarding journeys. Fortunately, success is a science rather than a mystery.

Yes, there’s a science-based solution!

Let’s dive in.

Here’s how Customer Journey Management works:

1. It’s a voyage of discovery

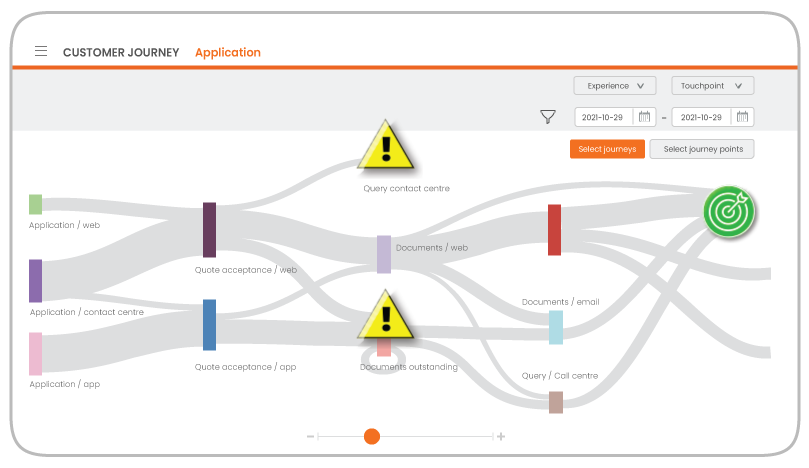

Rather than the journey map that was workshopped and immortalized on the boardroom wall, you need to understand your policy holders’ real journeys. Especially the messy bits – like the policy holder segment that requested a call-back which resulted in numerous representatives trying to make contact at times that customers were unavailable, before they just dropped away quietly. Your journey map won’t help with these real-time views.

In contrast to journey mapping, this step of journey management uses your existing data to expose and visualize customers’ real journeys and actual behavior. This includes drop-offs and goals. This view is always the ‘penny drop moment’ for executives, but it’s only the beginning.

2. But how do they really feel?

Add an emotional layer by collecting customer feedback and emotional context at each step, in the moment. Is value being delivered and received during the claims process? How was the onboarding experience? This insight will guide the interventions and types of help that your business will design as part of the journey optimization.

3. The why behind their behavior

Now you have emotional context for your policy holders’ actual journeys and can uncover the ‘why’ behind their behavior. This is where you’ll discover that perhaps the brand wasn’t being delivered sufficiently to all segments during the claims process, or that the product didn’t make economic sense to some prospects during onboarding (although the experience itself was amazing!).

This segment-specific insight is what you’ll need to design interventions and scale empathy.

4. Encourage the behavior you want

Empowered with behavioral detail and emotional context, you can now scale empathy by designing hyper-personalized, real-time digital interventions and nudges to guide certain behaviors. An informational engagement may offer important information at a step in the onboarding process, or a chat may encourage portal registration, or market add-on services at the appropriate time.

5. Fine-tune for success

Review the success of strategies in a closed-loop, iterative and ongoing manner. Did digital nudges boost onboarding conversion? Did you achieve the implementation ROI that was targeted? Were intervention strategies effective during the claims process, ensuring loyalty and better lifetime value? Make small updates to further improve goal achievement.

How Customer Journey Management addresses your biggest challenges

[table id=1 /]

Use case coming up!

Look out for our forthcoming newsletter and post where we’ll be looking at how a leading insurer improved conversion during sales and onboarding – and ensured that their policy holders had positive experiences. You’ll learn more about customers’ journeys were orchestrated and nudges were used to improve conversion and other important business metrics.

We would love to understand your business challenges and the problems you’re trying to solve. Reach out to us and we’ll set you up with an expert for a no-obligation discussion.

Guide customer behavior with inQuba Journey Management

Download our product paper now